The Federal Government has garnered a total of N11 trillion through auctions and sales of Treasury bills and savings bonds issuance over four months, as revealed by findings from The PUNCH.

Analysis of results from the Central Bank and the Debt Management Office indicated that between January and April 2024, the government raised N3.1 trillion in FGN bonds and N7.92 trillion in T-bills, amounting to N11.2 trillion.

These financial instruments, essential for the government’s debt management strategy, serve various purposes, including providing investors with a secure investment option, managing the country’s debt profile, and facilitating efficient fund management.

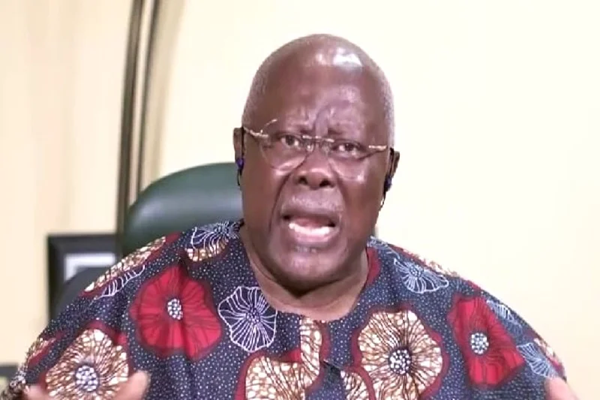

Professor Sheriffdeen Tella, an Economics expert, described bonds and treasury bills as viable solutions for raising funds while reducing foreign debts. He emphasized their role in both funding government operations and managing liquidity in the financial system.

Tajudeen Ibrahim, Director of Research and Strategy at Chapel Hill Denham, highlighted the importance of financial literacy in maximizing investment opportunities in treasury bills and bonds. He urged the government to focus on improving public awareness to enhance funding through these avenues.

Interested individuals can open investment accounts with portfolio investors, financial institutions, or insurance companies to access these investment opportunities, Ibrahim explained. He emphasized the benefits of investing in bonds and treasury bills compared to traditional savings accounts, noting that it offers higher returns and is more rewarding in the long run.